01 March, 2022

SBP relaxes home financing conditions for under construction houses

Apex News

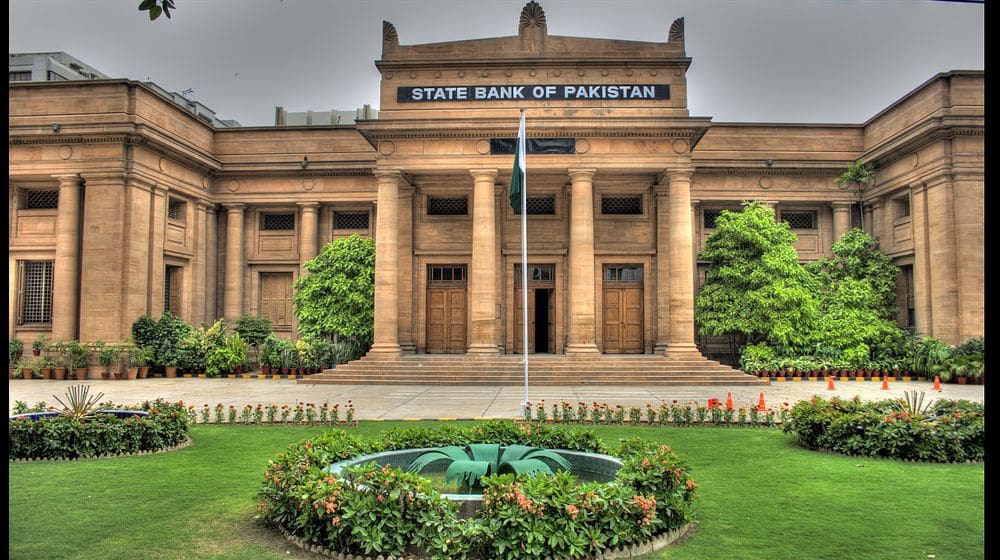

The State Bank of Pakistan (SBP) has relaxed home financing conditions for disbursement of loans for under-construction houses and directed the commercial banks to make sure smooth provision of loans even to individual buyers of property.

According to the recent statement issued by the central bank of Pakistan, instructions have been given to facilitate the provision of loans to commercial banks for construction companies working on under-construction residential projects.

The statement further said, “Buyers of homes in developing projects may avail housing finance against their units in the scheme where builder or developer has not availed construction financing.”

Earlier, banks used to take 18 months to disburse five per cent for the period, which ended on December 31, 2021. The SBP has now guided national commercial banks to raise the minimum amount of housing loans to seven per cent of their total allocation to the private sector in 2022.

For more details and safe investments, contact Apex Group.

.png)

.png)